plus setup fee

plus setup fee

plus setup fee

plus setup fee

plus setup fee

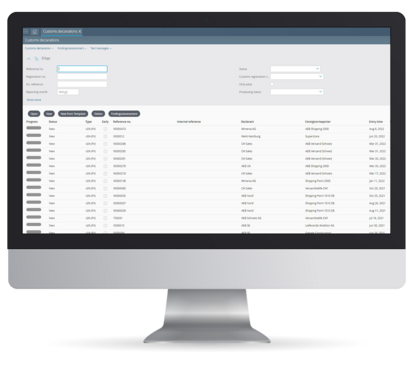

- Automated or manual completion of customs declarations, certified for the ATLAS procedure

- Direct connection of customs communication via a central, high-performance data center

- Support for all standard import and transit procedures

- Create import documents (Full frontier declarations, simplified frontier declarations, supplementary declarations)

- Archiving of customs-relevant ATLAS messages

- Electronic customs tariff (TARIFE)

- Intrastat

- Intelligent templates

- Automated email notifications

- Data to support analytics

- Integrated wizard

- Support

- Transit procedures (NCTS Zugelassener Empfänger (ZE))

- Archiving

- Integration into other ERP systems*